By Anthony M. Wanjohi:

There are various sources of funds for Small and Medium Enterpries (SMEs) in developed and developing countries. This article briefly explores the sources based on developing world perspective.

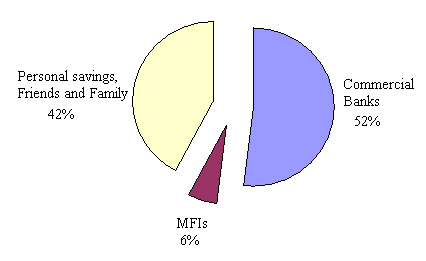

In a study that was conducted on Small and Medium Enterprises in Nairobi Central Business District, the main sources of funds for entrepreneurs included commercial banks, Micro-Financial Institutions (MFIs) and personal, friends and families (Kamau, 2010). Figure 1 shows the distribution of entrepreneurs on the common sources of business funds.

Fig. 1: Sources of funds among entrepreneurs

As shown by Figure 1, slightly over half (52 per cent) of the respondents indicated that the most common source of business fund was commercial banks. Another common source according to 42 per cent of the respondents was personal savings, friends and family. Surprisingly, Micro-Financial Institutions appeared to be not common source of funds for entrepreneurs in Nairobi Central Business District. The variations in sources of funds could be attributed to urban trends in borrowing where banks are readily available as compared Micro-Financial Institutions which are predominantly in rural set-up. There is also some level of doubts that people have on the authenticity of MFIs. Lack of access to long-term credit for small enterprises thus, forces them to rely on high cost short term finances which in turn hinder their very growth.

There are other key sources of funds that were silent among the entrepreneurs in the study. These included the government and Non-Governmental Organizations. Thus, there is need for government and other development partners to focus much more on the SMEs’ support agenda in order to enhance sustainable development in developing countries.

Reference

Kamau, P. (2010). Managing Challenges Facing Small and Medium Enterprises in Nairobi Central Business District. Journal of Research Abstracts, JRA, Volume 4, 2010.