By Anthony M. Wanjohi:

Small and Medium Enterprises (SMEs) have over long time been recognized as boosters of economy in both developed and developing countries. These enterprises constitute a major source of employment and generate significant domestic and export earnings (Organization for Economic Co-operation and Development (OECD, 2004). Despite their critical role in economic development, these enterprises continue to face enormous challenges – the major one being financial accessibility. This article outlines the key approaches that can be adopted to enhance financial accessibility among SMEs.

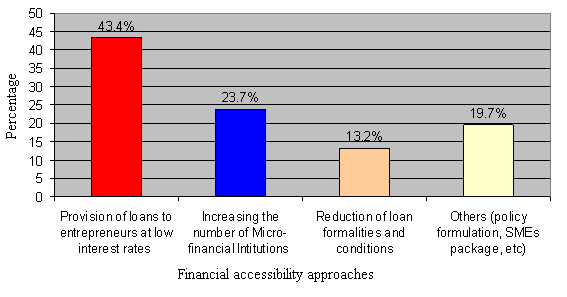

A number of studies have been conducted to establish the major challenges facing SMEs especially in the developing countries. A few though have examined the key approaches that can be adopted to address the challenges. A study by Kamau (2010) is one such study which established a number of approaches that can be used to address the plight of financial accessibility among SMEs. Figure 1 summarizes the suggestions from various entrepreneurs who took part in the study.

Fig.1: Approaches towards improving financial accessibility among SMEs

Sound approaches that facilitate the accessibility of finances by Small and Medium Enterprises were suggested. 43.2 per cent of the respondents indicated that provision of loans to entrepreneurs at low interest rates could help the growth of their businesses. While low interest rates can not be the solution to all the challenges related to financial accessibility, 23.7 per cent of the respondents suggested that increasing the number of micro-financial institutions could also help in transforming the sector. Other approaches included an overall reduction to loan formalities and conditions and formulation of sound SMEs policies.

These approaches are crucial in stabilizing the operations of SMEs. However, there is need to address other challenges (besides financial accessibility) that contribute to stagnation among SMEs especially in developing countries. These include but not limited to unfriendly legal and regulatory framework, lack of managerial skills, poor infrastructure, poor business linkages (network), poor market among others.

References

Kamau, P. (2010). Managing Challenges Facing Small and Medium Enterprises in Nairobi Central Business District. Journal of Research Abstracts, JRA, Volume 4, 2010.

Organization for Economic Co-Operation and Development (OECD) 2006). Financing SMEs and Entrepreneurs. Retrieved December 20, 2012 from http://www.oecd.org/dataoecd/53/27/37704120.pdf